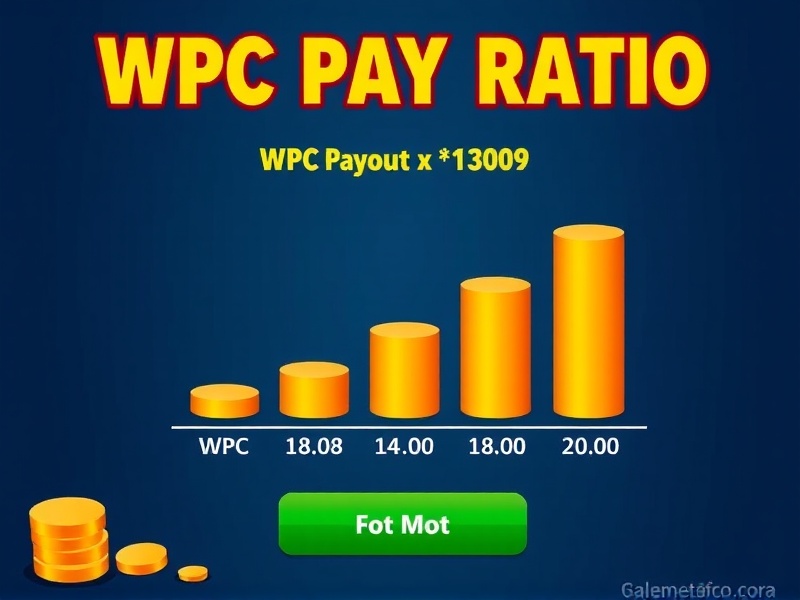

wpc payout ratio

Understanding the Concept of WPC Payout Ratio

The WPC payout ratio is a financial metric that indicates the percentage of earnings paid out to shareholders in the form of dividends. It is calculated by dividing the total dividends per share by the earnings per share (EPS) over a given period. For example, if a company has a dividend of $1 per share and an EPS of $2, the WPC payout ratio would be 50%. This ratio helps investors gauge whether a company is distributing enough profits to its shareholders or retaining more earnings for reinvestment.

The Importance of WPC Payout Ratio for Investors

The WPC payout ratio is crucial for investors because it provides insights into the sustainability of a company’s dividend payments. A high payout ratio may indicate that a company is paying out a large portion of its earnings as dividends, which could suggest that there might not be sufficient funds available for future growth or unexpected expenses. Conversely, a low payout ratio might suggest that a company is reinvesting most of its earnings back into the business, potentially leading to higher future growth rates. However, a very low payout ratio could also signal that the company is not generating enough profits to reward shareholders adequately.

Real-World Examples of WPC Payout Ratio Impact on Investment Decisions

Consider the case of a utility company with a stable but slow-growing revenue stream. Historically, this company has maintained a high WPC payout ratio, reflecting its commitment to returning profits to shareholders. Investors attracted to steady income streams might find this company appealing. However, if the company’s earnings begin to decline, maintaining a high payout ratio could become unsustainable, potentially leading to a dividend cut, which would negatively impact the stock price.

In contrast, a tech startup with explosive growth potential might have a very low WPC payout ratio, as it focuses on reinvesting profits to fuel expansion. Investors in this sector are typically more interested in capital appreciation rather than dividend income, making a low payout ratio less concerning.

Conclusion

The WPC payout ratio is a valuable tool for investors seeking to understand the balance between current income from dividends and future growth prospects. By analyzing this ratio alongside other financial metrics and industry trends, investors can make more informed decisions about their investments. Understanding the implications of different payout ratios can help investors avoid companies at risk of cutting dividends and identify those poised for long-term success.

Reviews

There are no reviews yet.