WPC Dividend Payout Ratio Analysis: Trends and Insights

Trends in WPC’s Dividend Payout Ratio

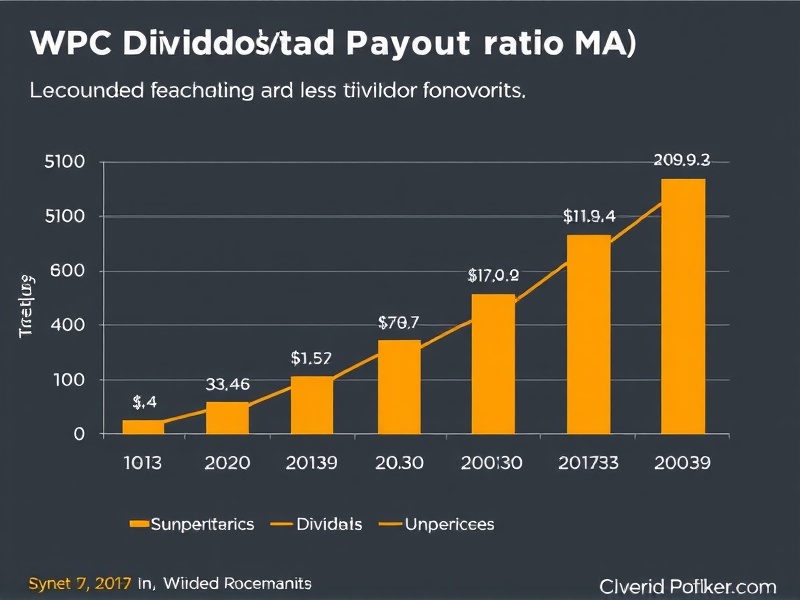

The WPC (Wood Products Corporation) has been a notable player in the wood products industry, known for its commitment to sustainable practices and financial stability. Recently, there has been an increasing interest in understanding the trends of WPC’s dividend payout ratio. This ratio is a key financial metric that indicates the percentage of earnings paid out as dividends to shareholders. According to recent data, WPC’s dividend payout ratio has shown some interesting fluctuations over the past few years.

Comparison with Industry Benchmarks

To provide context, it’s essential to compare WPC’s dividend payout ratio with industry benchmarks. The average dividend payout ratio in the wood products sector typically ranges between 30% and 50%. However, WPC has consistently maintained a higher payout ratio, often reaching up to 70%. This suggests that WPC prioritizes rewarding its shareholders while maintaining a balance with reinvestment needs.

Strategic Decisions Influencing Changes

The strategic decisions made by WPC’s management team play a crucial role in shaping the company’s dividend payout ratio. In recent years, the company has focused on expanding its operations and investing in new technologies aimed at improving sustainability. These investments have required significant capital, which could explain the occasional dip in the dividend payout ratio. Conversely, periods of strong financial performance have allowed the company to increase dividends, reflecting its confidence in future growth prospects.

Potential Future Movements

Forecasting future movements in WPC’s dividend payout ratio involves considering several factors, including market conditions, operational efficiency, and strategic initiatives. If WPC continues to expand its global footprint and successfully integrates advanced technologies, it may be able to maintain or even increase its dividend payouts. On the other hand, economic downturns or increased competition could pressure the company to reduce dividends to preserve cash flow.

Conclusion

In summary, WPC’s dividend payout ratio provides valuable insights into the company’s financial health and strategic direction. While the current ratio exceeds industry averages, it reflects a balance between rewarding shareholders and reinvesting in growth opportunities. As the company navigates through various challenges and opportunities, monitoring this ratio will remain crucial for investors seeking to understand WPC’s long-term strategy.

Reviews

There are no reviews yet.