wpc dividend payout ratio

Understanding the Calculation Methodology

The dividend payout ratio is a key financial metric that measures the proportion of earnings a company pays out to shareholders in the form of dividends. For WPC (W.P. Carey Inc.), a real estate investment trust (REIT), this ratio is particularly important as it reflects the company’s ability to sustain dividend payments from its profits. The formula to calculate the dividend payout ratio is straightforward: it is the total amount of dividends paid out to shareholders over a specific period divided by the net income or free cash flow generated during the same period.

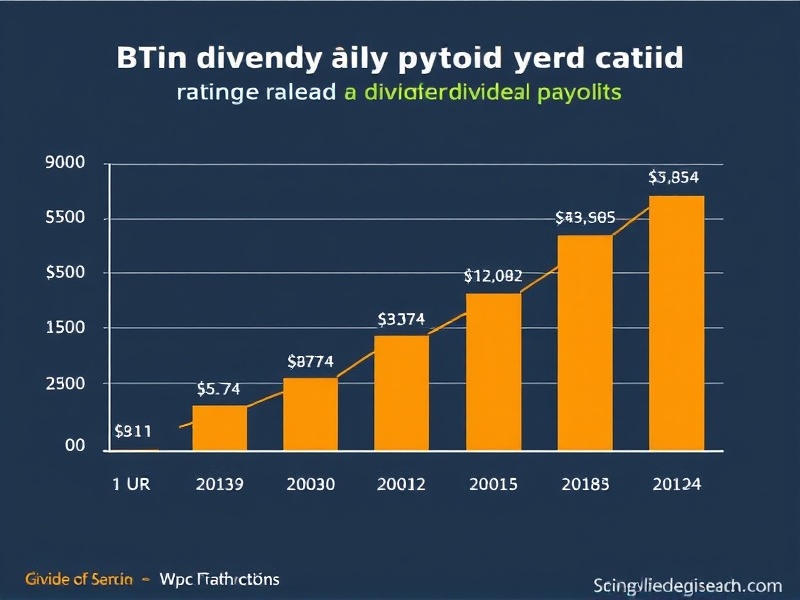

Historical Data and Trends

Over the past five years, WPC has maintained a relatively stable dividend payout ratio, generally ranging between 70% to 80%. This indicates that the company consistently distributes a significant portion of its earnings back to shareholders while retaining enough to support growth initiatives. As of the latest fiscal year, WPC reported a dividend payout ratio of approximately 75%, which suggests a healthy balance between distributing returns to investors and reinvesting in business expansion.

Implications for Investors

A consistent and sustainable dividend payout ratio like WPC’s can be an attractive feature for long-term investors seeking regular income streams. However, it also raises questions about the company’s future growth prospects. A high payout ratio might indicate that the company is currently maximizing shareholder returns but may limit its capacity for future investments or expansion. Conversely, a lower ratio could signal strong reinvestment into growth opportunities, potentially leading to higher stock prices and dividends in the future.

Expert Opinions

Financial analysts and experts have mixed views on the sustainability of WPC’s current payout levels. According to a report by [Bloomberg](https://www.bloomberg.com/), WPC’s management has expressed confidence in maintaining its current payout ratio due to robust rental income and a diversified portfolio. However, some economists caution that any significant downturn in commercial real estate markets could impact the company’s ability to sustain these payouts. It is crucial for investors to consider both the current payout ratio and broader economic conditions when evaluating WPC’s investment potential.

Reference

Bloomberg: A comprehensive source for financial news and analysis.

Reviews

There are no reviews yet.