WPC Dividend 2024: Key Dates for Investors

$4.99

Stay informed about crucial dates related to the WPC dividend for 2024, such as ex-dividend date, record date, and payment date, to optimize your investment strategy.

WPC Dividend 2024: Key Dates for Investors

Introduction

The year 2024 is shaping up to be a significant one for investors in WPC (W.W. Grainger Inc.). As one of the leading companies in industrial supplies and services, WPC has historically provided steady dividends to its shareholders. For those looking to capitalize on these payments, it’s crucial to understand the key dates surrounding the WPC dividend in 2024. This article will provide a detailed timeline of these dates, along with actionable advice on how to time your investments effectively.

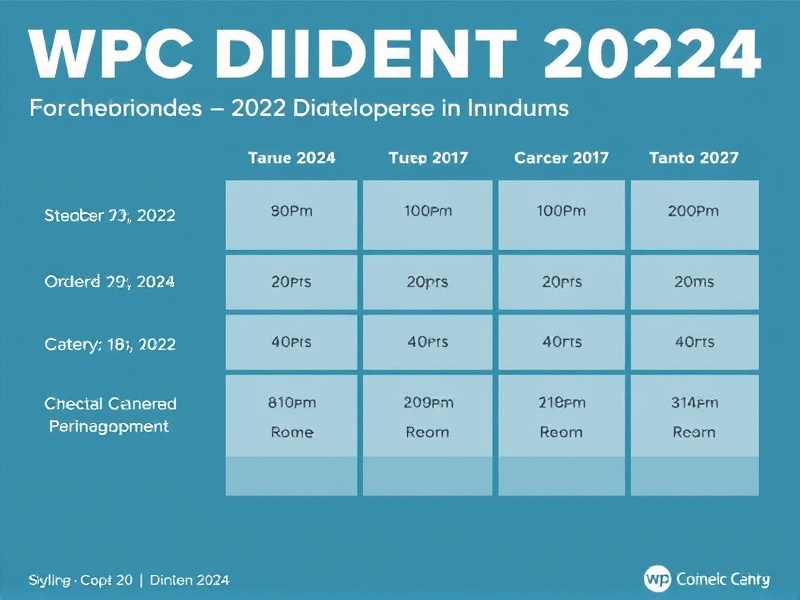

Key Dates for WPC Dividend in 2024

Declaration Date

The declaration date is when the company announces that it will pay a dividend. This announcement typically includes the amount of the dividend, the ex-dividend date, and the payment date. For WPC in 2024, the declaration date is expected to be around February 15th. Investors should note this date as it is critical for understanding the company’s financial health and dividend policy.

Ex-Dividend Date

The ex-dividend date is the day before which an investor must own the stock to receive the upcoming dividend. For WPC, the ex-dividend date is set for March 1st, 2024. If you purchase WPC stock after this date, you will not be eligible for the dividend payout scheduled for March 15th, 2024. It’s essential to plan your investment strategy accordingly to avoid missing out on this opportunity.

Record Date

The record date is the cutoff point used by the company to determine who is entitled to receive the dividend. For WPC in 2024, the record date is March 5th, 2024. On this date, the company will compile a list of shareholders who are eligible for the dividend based on their holdings as of the ex-dividend date. Investors should ensure they are listed on this record to secure their dividend payment.

Payment Date

The payment date is when the dividend is actually distributed to shareholders. For WPC in 2024, the payment date is March 15th, 2024. This is the day when investors can expect to see the dividend credited to their accounts. It’s important to keep this date in mind if you are planning to reinvest the dividend or use it for other financial purposes.

Actionable Advice for Investors

To maximize the benefits of investing in WPC during the dividend period in 2024, consider the following strategies:

- Buy Before the Ex-Dividend Date: To ensure eligibility for the dividend, investors should aim to buy WPC stock before the ex-dividend date of March 1st, 2024.

- Reinvest Dividends: Consider reinvesting the dividends back into WPC stock to compound your returns over time. Many brokerage firms offer dividend reinvestment plans (DRIPs) that can automate this process.

- Monitor Company Performance: Keep an eye on WPC’s quarterly earnings reports and any updates from management. Strong performance can bolster confidence in the company’s ability to sustain dividend payouts.

Conclusion

Understanding the key dates for the WPC dividend in 2024 is vital for making informed investment decisions. By keeping track of the declaration, ex-dividend, record, and payment dates, investors can strategically position themselves to benefit from the dividend payouts. With careful planning and attention to market dynamics, investors can enhance their returns and build a robust portfolio in 2024.

Reviews

There are no reviews yet.